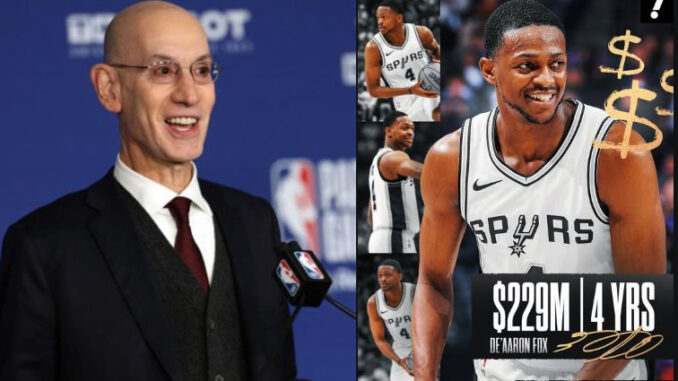

The San Antonio Spurs made waves in early August by signing star point guard De’Aaron Fox to a four-year maximum contract extension worth up to $229 million, per ESPN’s Shams Charania. While the move secures a proven lead guard alongside franchise centerpiece Victor Wembanyama, it has sparked debate over whether Fox merits a full max deal under today’s restrictive NBA financial landscape.

ESPN’s Kevin Pelton cautioned that Fox’s contract could prove costly in the long run. Though he was an All-Star and All-NBA third-team selection in 2022-23, Fox’s skill set may not age gracefully, and his $50+ million annual salary could eventually weigh down San Antonio’s flexibility just as Wembanyama reaches his peak.

Why the Spurs Took the Risk

At present, the Spurs have the flexibility to absorb Fox’s deal. Wembanyama won’t be extension-eligible until next summer, though he is expected to command a max contract that could start at 30% of the cap in 2027-28 if he earns All-NBA, MVP, or Defensive Player of the Year honors. Alongside him, Stephon Castle (2024 Rookie of the Year) is locked into his rookie-scale contract for three more years, and 2025 No. 2 pick Dylan Harper is just starting his. That gives San Antonio at least two seasons to evaluate its backcourt and decide whether Fox, Castle, and Harper all fit together long term.

The Spurs’ salary sheet is already structured with this in mind. Devin Vassell is signed through 2029 on a flat five-year, $135 million deal. Veteran contracts such as Harrison Barnes ($19M) and Kelly Olynyk ($13.4M) will expire after this season, while Keldon Johnson is on a steady $17.5 million annually through 2027. Even Luke Kornet’s recent four-year, $40.7 million signing is low-risk, with minimal guarantees and team options in the out-years.

In short, San Antonio has imitated the reigning champion Oklahoma City Thunder, who structured deals with built-in flexibility around their young stars. This careful planning means the Spurs are unlikely to face restrictive “second apron” penalties in the next few years despite Fox’s hefty price tag.

The Changing Max-Contract Landscape

The bigger question is what happens if Fox declines or the Spurs eventually want to move on. The NBA’s new collective bargaining agreement has drastically changed how teams evaluate max contracts. Under the old CBA, players of Fox’s caliber were near-automatic max recipients. But the introduction of the punitive second apron—which restricts trades, signings, and roster-building tools for the highest-spending teams—has made front offices more cautious.

The Atlanta Hawks’ hesitation with Trae Young illustrates the new mindset. Despite Young’s offensive brilliance, Atlanta has consistently fielded poor defenses, and with future decisions looming on players like Dyson Daniels and Kristaps Porziņģis, the Hawks are wary of locking into another supermax commitment that could push them into apron territory without a proven path to contention.

Examples abound of max deals that quickly lost value. The Denver Nuggets once gave Michael Porter Jr. a five-year max, only to trade him and a future first-round pick to Brooklyn two years later for the cheaper Cam Johnson. Similarly, the Utah Jazz extended Lauri Markkanen for nearly $196 million after his breakout, only to watch his production regress the following year—raising questions about whether his deal could become an albatross.

The Spurs’ Gamble

For San Antonio, the gamble is clear: Fox provides a proven All-Star guard to stabilize the team’s young roster and give Wembanyama immediate support. But if his play declines before or during Wembanyama’s prime, the Spurs risk having a $229 million commitment that hampers their ability to maximize their generational star.

The Spurs’ management is betting that Fox will maintain his value, either as Wembanyama’s running mate or as a tradeable asset. With at least two seasons of flexibility before Wembanyama, Castle, and Harper’s extensions converge, the Spurs can afford to take that chance. Whether Fox ultimately proves worth it—or becomes another example of the new CBA’s harsher contract realities—will define San Antonio’s trajectory in the coming years.

Leave a Reply